We offer dynamic, adaptable financing that moves with your business, providing the right amount of capital exactly when you need it.

When it comes to business financing, flexibility is indispensable. That’s why we offer multi-draw advances to give your business the flexibility you need throughout the year. Instead of being locked into a large lump sum amount of financing – with Specialty Capital, you can secure a flexible amount of financing that’s available whenever you need it. This gives you more freedom and control of your cash flow so you can expand your business and navigate expenses as they arise. Here’s how a multi-draw advance works and why it could be a great solution for your business.

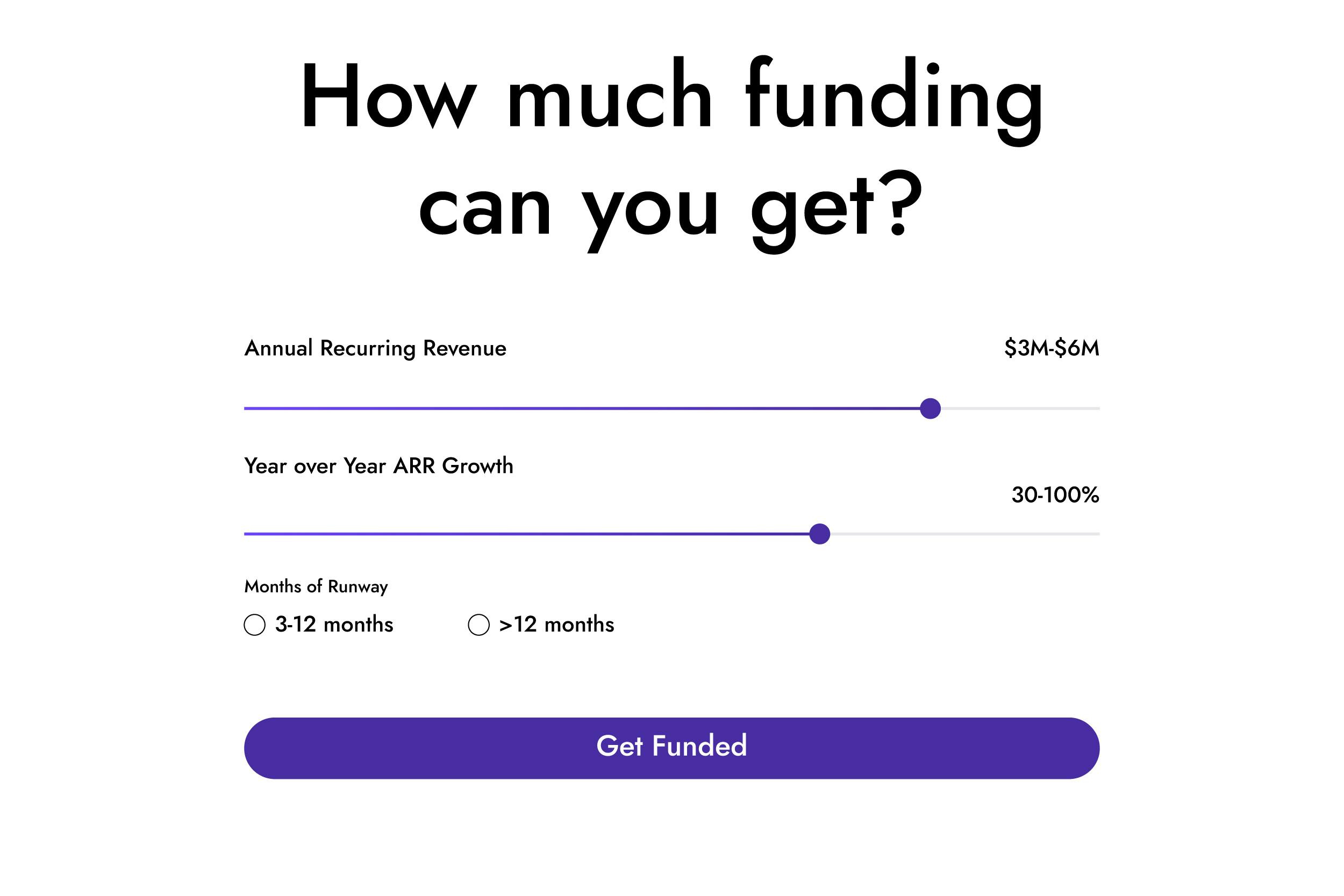

Experience the flexibility of multi draw advances, where we approve your business for a maximum financing amount, acting like a revolving line of credit. This unique approach enables you to draw any amount under the limit while retaining access to the full sum whenever needed. Ideal for businesses with seasonal sales cycles or irregular cash flow, providing on demand access to cash.

Upon evaluating your business, we’ll allocate a maximum credit limit for your business. Cost is only incurred on the amount withdrawn, ensuring a more economical financing option compared to traditional options. As you repay the drawn amount, your available credit is replenished, allowing for continuous on demand access to funds.

Because your payments are revenue based, you aren’t forced to make larger payments than you can afford. This aligns your financial obligations with your business success, ensuring sustainable growth and stability as your business evolves.

If you operate a software development company and need capital to grow your team and expand your marketing efforts – a multi-draw advance can be an excellent tool to get the capital you need.

By taking advantage of a multi-draw advance, you can utilize only the capital you need, helping you reduce costs while keeping an open line of capital that you can draw from whenever needed. Each advance comes with prepayment discounts for the entire life of the advance so you can also save cost of capital by paying off early and then taking another draw.

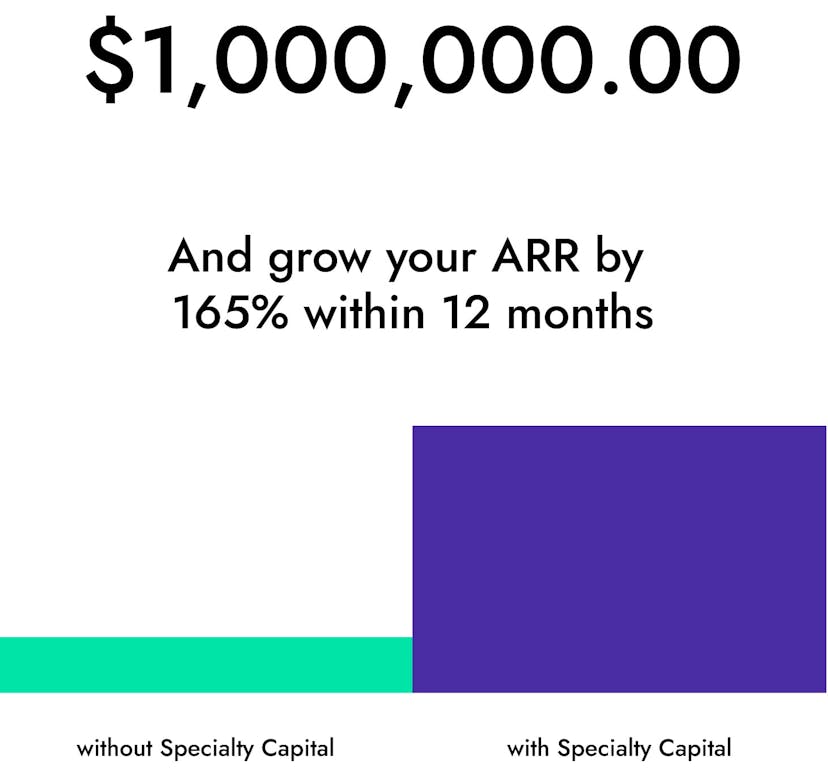

Our multi-draw advance product helps to drastically lower the amount of your financing while also offering greater flexibility to help you grow your business.