We leverage your incoming revenue as collateral, offering an innovative alternative to traditional asset-based lending.

There’s no doubt that running a business comes with a variety of challenges and obstacles that even the most skilled entrepreneurs can have difficulties with. Whether you’re looking to grow your team, expand to new locations, or boost your inventory for the holiday season – finding the capital to meet your goals can be cumbersome.

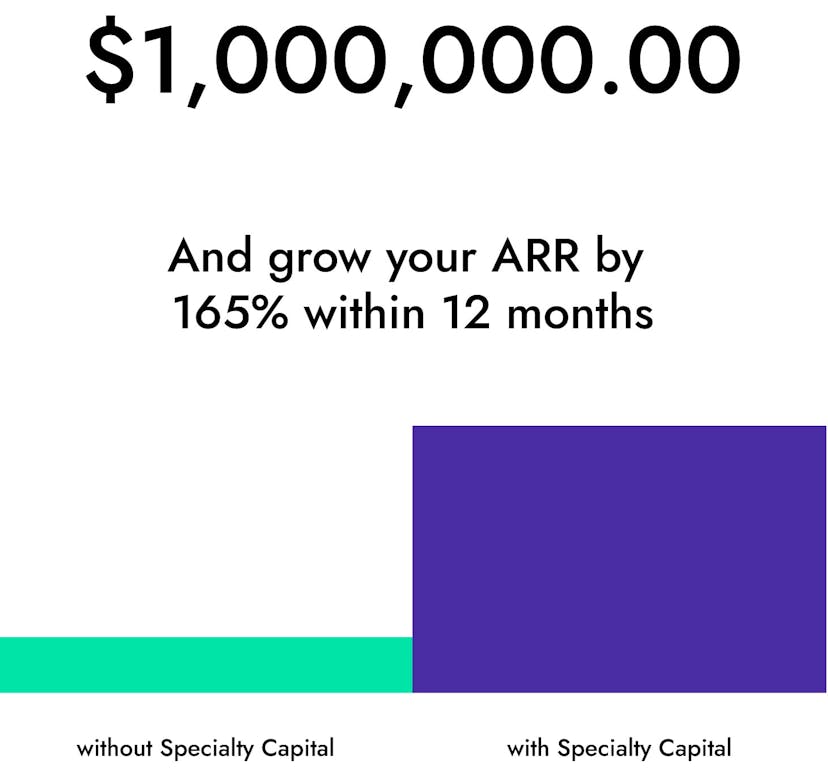

That’s where revenue-based financing comes in. Specialty Capital works to provide you with the financing you need to exceed your long-term goals, so you can focus on running your business. Here’s how it works, the qualifications you’ll need, and how to get started.

We leverage your incoming revenue as collateral, offering an innovative alternative to traditional asset-based lending.

With our streamlined process, you can get quick access to funds, ensuring that your business can swiftly respond to growth opportunities and financial needs.

Thanks to payments being tied to your revenue, you’re not pressured into making larger payments than your business can comfortably afford, ensuring flexibility with your finances.

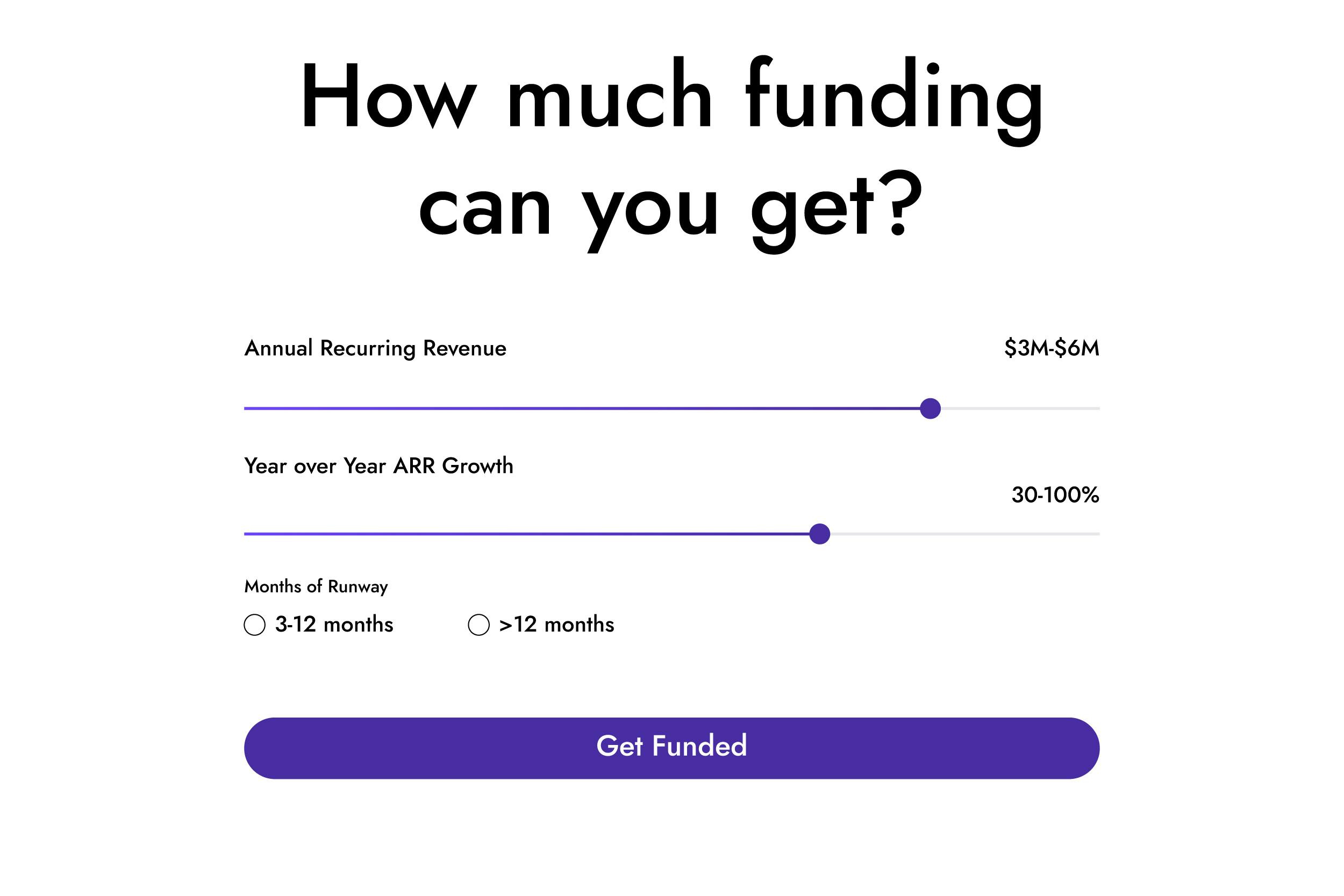

You need money to expand your commercial construction company, but you don’t have collateral needed to qualify for other forms of financing.

With revenue-based financing, you can use your income as collateral for your financing to get the money you need to grow your business. You just make small weekly payments based on your current revenue until the financing is paid.

By using our revenue-based financing, you’re able to grow your brokerage and take advantage of industry leading prepayment discounts to keep your costs low.