We offer industry-leading prepayment discounts that reduce the cost of your financing so you can build your business.

When it comes to financing for your business – the costs can be exorbitant. But at Specialty Capital – we take a unique approach to your financing to help you save money and stress less. That’s why we offer industry-leading prepayment discounts that reduce the cost of your financing so you can build your business. With our revenue-based financing product, you can get the capital you need without the hassle of traditional loan options. Here’s how our prepayment discounts work so you can get the most affordable financing available.

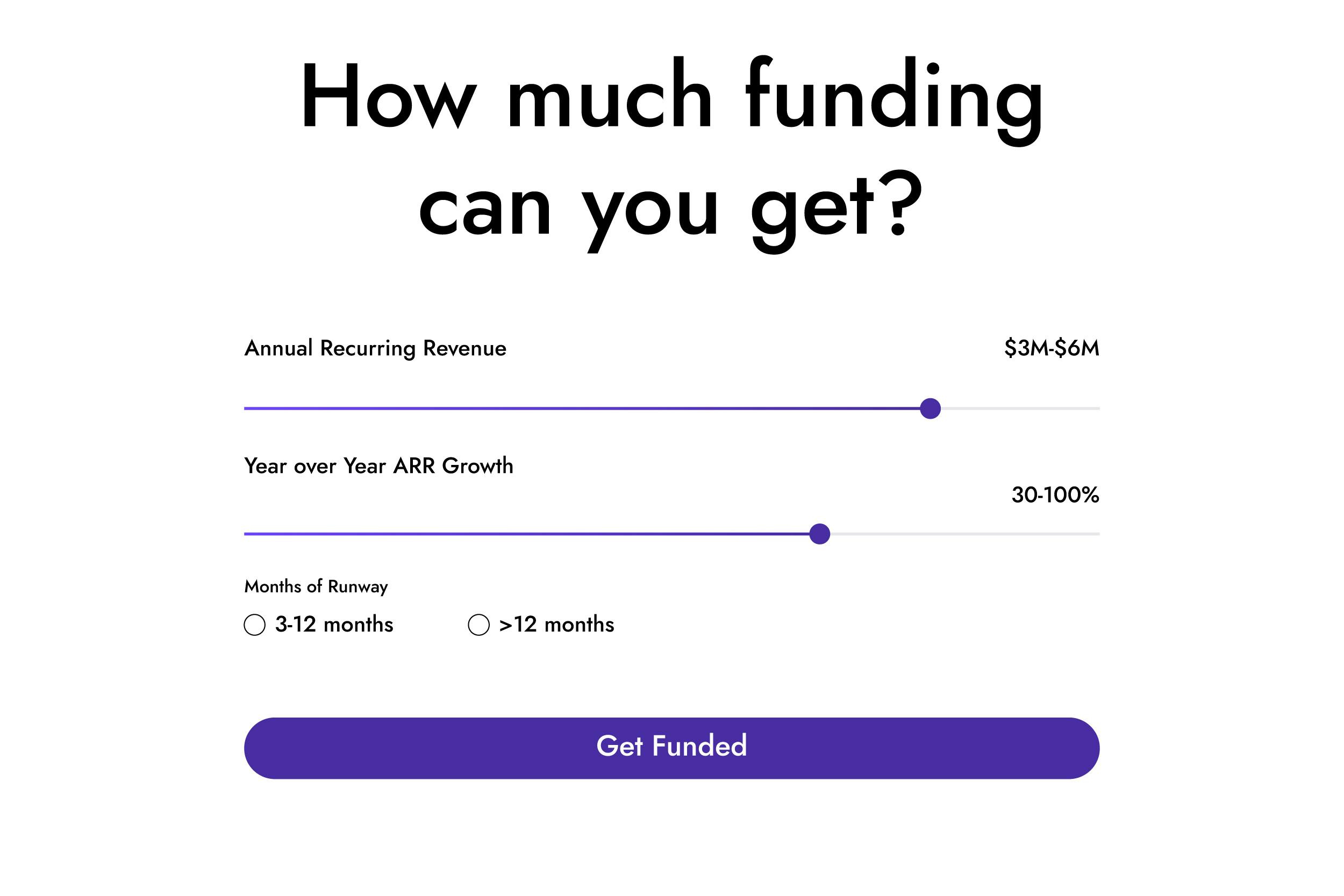

We look beyond credit scores to help you secure the financing you need. By using your business’s revenue as collateral, we offer a more flexible and accessible funding solution, tailored to your company’s actual performance and potential.

Specialty Capital offers enticing prepayment discounts, presenting a unique opportunity to reduce financing expenses. This feature proves beneficial for managing payroll, inventory, or other operational costs with slightly delayed income.

Bridging accounts receivable gaps becomes seamless with our prepayment discounts, enhancing the affordability of running your business. Our hands-on approach allows us to collaborate with you in finding the optimal long term financing solution to exceed your business goals.

If you own a retail store and want to expand to new locations – you might need capital for additional inventory and startup expenses.

By taking advantage of our revenue-based financing options with prepayment discounts, you can secure the capital you need to expand to new locations.

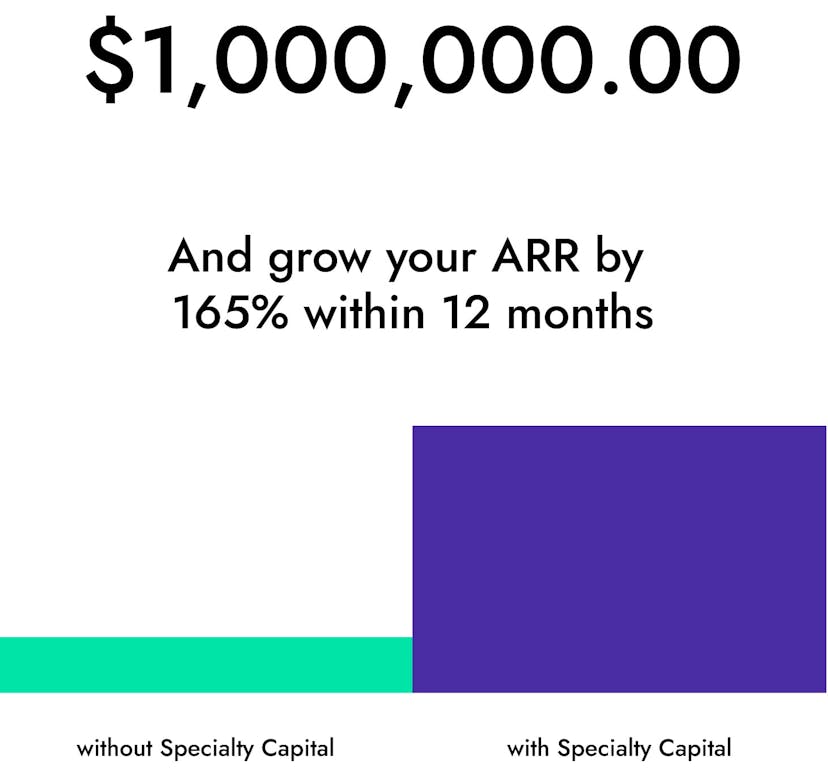

Our industry-leading prepayment discounts can make the cost of your financing extremely affordable so you can grow your business quickly and efficiently.